Do you feel overwhelmed by your finances? Have you ever asked yourself “where is my money going” or “why is money so tight”? Do you struggle to save regularly or have problems paying off debt? Are you planning for a major purchase or life event? Do you want to make the most of your money? If you answered yes, a budget is the perfect tool for you.

When it comes to managing your money, it’s good to have a plan. A budget is a spending plan that helps you balance your income with your savings and expenses to take control of your finances and reach your goals.

A budget can help guide your spending to live within your means, reduce any debt and save more. This reduces stress and gives you more money for things that are important to you—whether that’s a comfortable retirement, paying for your children’s education or a dream vacation to the Maldives.

To help you build that budget, we’ve put together some easy-to-follow steps.

Step one

Set some goals.

The key to making any plan is to know your goals—you need to know what you’re working towards. Take some time to determine what your short and long-term goals are.

| Examples of short-term goals | Examples of long-term goals |

| Pay off a credit card or loan. | Pay off all your debts. |

| Reduce your monthly spending. | Save money to buy a car or home. |

| Build an emergency fund. | Save money for home renovations or a vacation. |

| Pay for a wedding. | Save money for education, children or retirement. |

Pro tip: an emergency fund is important to help you handle expenses in unexpected situations—such as car maintenance, job loss or health issues—without getting into debt and going through financial stress. Your emergency fund should provide you with enough money to cover your living expenses for three to six months.

Step two

Know where your money is going.

Every dollar you spend affects your overall financial health. By looking at your expenses on an annual basis, you gain a better understanding of the true impact over time. You might be surprised how much seemingly inconsequential things, like your daily Starbucks, can add up over time. For example, if you spend $2.50 a day on coffee, it will cost you more than $900 a year!

To build a proper budget, you need to know how much is going in and out of your pocket. The easiest way to do this is to spend one or two months building a money log or journal.

- Write or type out everything you earn and spend from rent or car payments to a pack of gum or a cup of coffee. Not only will this help you track your money, but it will force you to reconnect with where it’s going.

- Categorize each expense and make note of which are daily, weekly, monthly, annual and one-time expenses. Categories may vary for each person, but we’ve listed some examples below to help you get started.

| Expense category | Examples |

| Debt repayment and fixed fees | Loan or credit card payments, bank and credit card fees, professional dues |

| Housing | Rent or mortgage, utilities, furniture and appliances, insurance |

| Communications | Phone bill, cable or satellite, Internet |

| Transportation | Vehicle loan or payments, insurance, gas, vehicle maintenance, licensing and registration, parking, public transportation, ride services |

| Health and wellness | Gym membership or classes, premiums and medical expenses not covered by your benefit plan, prescriptions, groceries |

| Personal care | Haircut and hair products, cosmetics and skin care, spa and beauty care |

| Clothing and accessories | Clothing, shoes, accessories, tailoring and shoe repair, laundry and dry cleaning |

| Children | Daycare, babysitting, education (current and future planning), after-school activities, summer camp, clothes, toys |

| Gifts and donations | Birthday and holiday gifts, weddings, donations |

| Entertainment and recreation | Travel and vacation, club memberships, shows and events, sports gear, computer and home entertainment, alcohol, subscriptions and memberships, dining out |

| Other | Cleaning products, pet expenses |

- Identify if each expense is a “need” or a “want”. A “need” is something necessary, required or essential, such as your housing, clothing, food and medication. A “want” is something you’d like, but don’t necessarily need like eating out, a vacation, a gym membership or designer shoes. Needs and wants can change over time and aren’t the same for everyone. For example, someone who doesn’t have access to public transit, may need a car to get to work.

Pro tip: set up a calendar reminder to take note of your expenses each day.

Step three

Crunch the numbers.

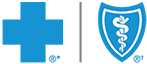

Now you’re ready to face the numbers. Use your money log to determine your average monthly and annual expenses. Then, calculate your income (after taxes) and determine how much, based on your current spending, you have available for your goals (in other words, your total income minus your total expenses).

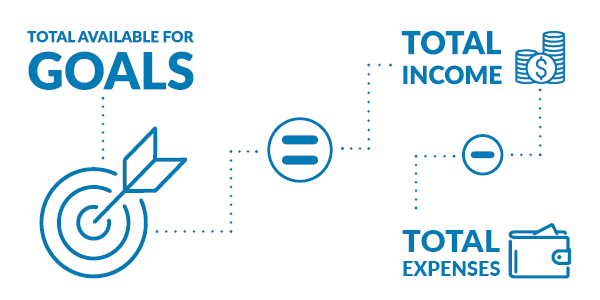

If you already have a savings plan in place but want to build a budget to help you save for another goal, you can adjust this formula. For example, if you contribute monthly to a TFSA, RESP or RRSP, you can include this in your calculation.

Pro tip: all this math is best done using a spreadsheet like Microsoft Excel or Google Docs. If you’re not comfortable using these programs, there are lots of free budget templates available online. You can also use an online budget tool like the Budget Planner from the Financial Consumer Agency of Canada or an app like You Need a Budget (YNAB), PocketSmith, Mint or PocketGuard.

Step four

Review, build and balance.

Now that you can see exactly where your money is going, it’s time to review your spending and set some limits. If the total available for your goals is less than what you need or what you expected, you’ll want to adjust your expenses in a way that allows you to increase or maintain your monthly savings.

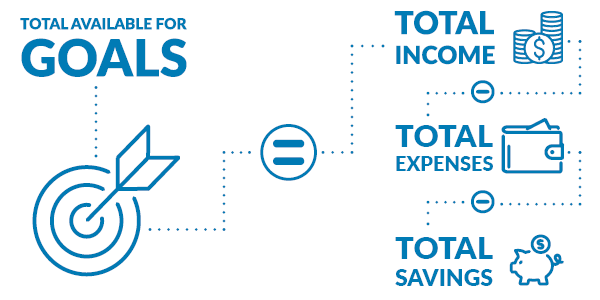

To provide you with a starting point, below are some guidelines for how much of your net income—after taxes—you should be budgeting.

Keep in mind that spending amounts will be different for everyone. If you have high expenses in one area, you may need to cut back in other areas to balance your budget. If you have flexibility with your finances, you can exceed the guidelines if you

- don’t spend more than you earn, and

- allocate some money towards savings for unexpected and future expenses.

When building your budget, focus on what you need first. Next, look at your “wants” and eliminate any unnecessary expenses or things you can live without. You can also find ways to reduce your expenses by modifying your habits, such as

- biking or using public transit instead of taking your car,

- bringing lunch to work instead of eating out,

- going for a walk with a friend instead of meeting them at café or bar, and

- visit a thrift shop to find a new outfit instead of going to the mall.

Remember that small changes to spending habits can have a major impact on your budget and your ability to save. Don’t forget to review your benefit plan—you may have a spending account that could cover some of your purchases. Learn more about health and wellness spending accounts on our blog.

Pro tip: look for adjustments to your spending habits that can not only improve your financial health, but your physical and mental health as well.

Step five

Implement and stick to your budget.

Now that you’ve built your budget, it’s time to incorporate it into your day-to-day life. Budgeting can be difficult, but here some tips to help you stick to it:

- Limit your spending as much as possible to stay within your budget.

- Pay with cash—this is particularly important for anyone who struggles with credit card debt but is also great for those trying to reign in their spending. Handing over physical money rather than a credit card forces you to evaluate if the purchase is necessary.

- Ask yourself if it’s something you need or want when making a purchase. Will spending that money get you closer to your financial goals or further away? Can you live without it? Set clear priorities for yourself and the decisions become easier to make.

- Use your money journal regularly to keep track of your spending and stay within your budget.

- Don’t miscategorise or exclude any purchases to avoid going over budget—be honest with yourself.

- Tell your family, friends and co-workers that you’re sticking to a budget to improve your financial health—be honest with others. Try responding with “I can’t afford it” when asked to do something that isn’t within your budget—it’s surprisingly empowering.

- Keep your budget updated with any changes such as pay raises and bill increases or decreases.

- Compare your budget to your actual spending at the end of each month.

- Re-evaluate your budget on a regular basis and, where necessary, adjust your figures to make your budget more realistic based on your spending.

It’s going to take some initial effort, and possibly some sacrifices, but budgeting gets easier over time and is well worth the financial confidence you get in return.

Resources

- Government of Canada – Budget Planner

- Government of Canada – Financial Goal Calculator

- Financial Consumer Agency of Canada

- My Money Coach

Sources: Government of Canada – Making a budget; Balance;My Money Coach; Best budgeting apps and tools on the market; The 30-Day Money Cleanse – Ashley Feinstein Gerstley